Roth 401k compound interest calculator

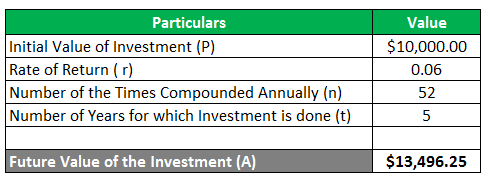

Formula for compound interest A P 1rnnt Where. Traditional 401 k and your Paycheck.

Compound Interest Example Practical Examples With Formula

A 401 k can be an effective retirement tool.

. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Whether you participate in a 401 k 403 b or 457 b program the. Investments That Adjust Over Time with a Goal of Carrying You To and Through Retirement.

Ad Attract and keep employees with 401k plans. This calculator assumes that you make your contribution at the beginning of each year. Traditional IRA calculator and other 401k calculators to help consumers determine the best option for retirement savings.

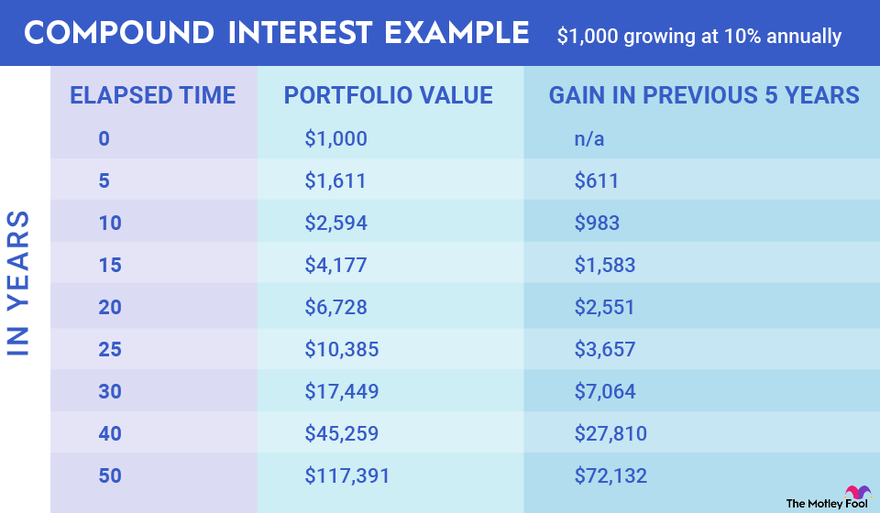

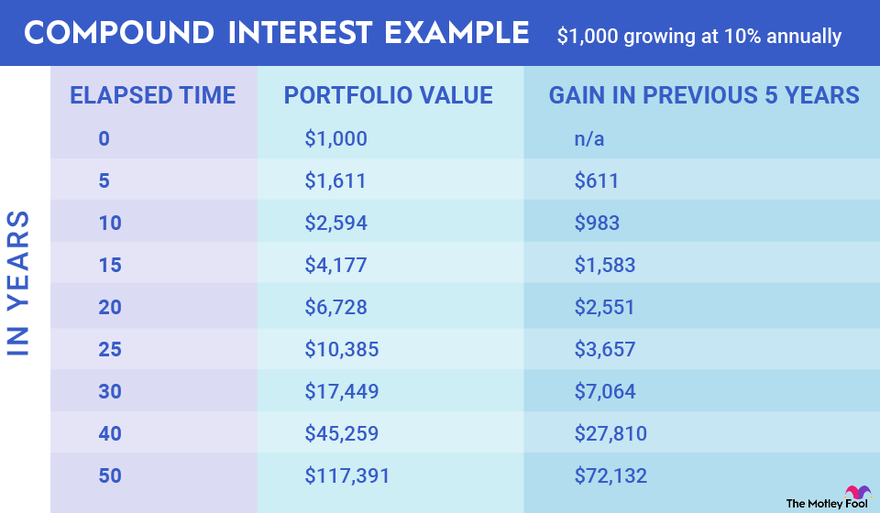

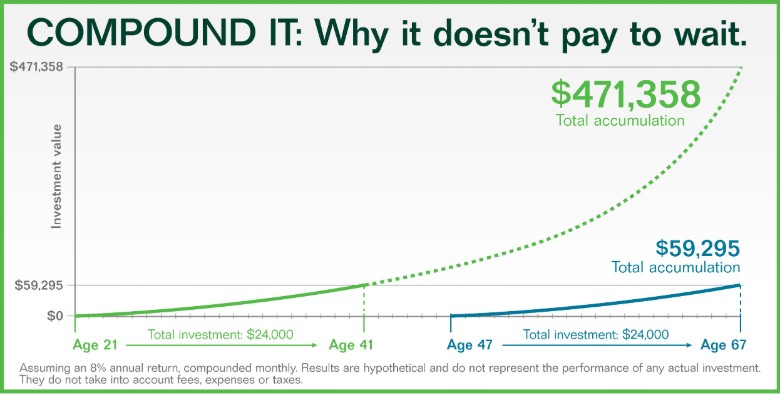

The Power of Compounding Growth. Here is how compound. A 401 k can be an effective retirement tool.

Ad See how Invesco QQQ ETF can fit into your portfolio. Compound interest calculator for Roth IRA. This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

Affordable easy payroll integrated. The amount you will contribute to your Roth IRA each year. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

Calculate your earnings and more. Lets look at how we calculate the year 20 figure using our compound interest formula. But rememberan investment calculator doesnt.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. 10 Best Companies to Rollover Your 401K into a Gold IRA. The Roth 401 k allows contributions to.

Ad Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture. A 401 k can be one of your best tools for creating a secure retirement. The Sooner You Invest the More Opportunity Your Money Has To Grow.

Enter the Initial Investment Amount Enter the Annual Interest Rate Put the. First all contributions and earnings to your 401 k are tax deferred. As of January 2006 there is a new type of 401 k contribution.

See How We Can Help. You can adjust that contribution down if you. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

It provides you with two important advantages. Ad Age-Based Funds that Make Selection Simple. An investment calculator is a simple way to estimate how your money will grow if you keep investing at the rate youre going right now.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. In addition many employers will match a portion of your contributions so. If you dont have data ready.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. When it comes to investing time is a powerful ally.

Roth 401 k contributions allow. A the future value of the investment or loan P. Income tax bracket accumulation phase 0 to 75 Taxation of contribution options.

Small business 401k plans with big benefits. Compounding may go a long way toward helping you with your retirement goals. Mortgage Loan Auto Loan.

Penelope makes it simple. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Choose the appropriate calculator below to compare saving in a 401k account vs.

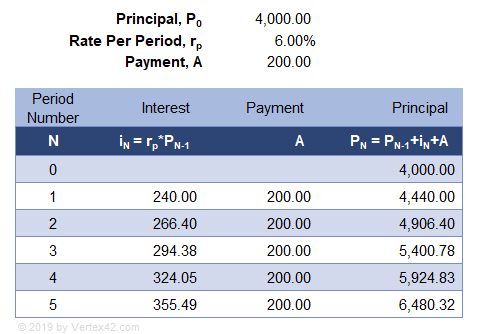

Ad Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. The Roth 401 k allows contributions to.

The Sooner You Invest the More Opportunity Your Money Has To Grow. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

For 2022 the maximum annual IRA. A Roth IRA. You can easily perform this calculation using our Compound Interest Calculator Roth IRA.

A 401 k is an employer-sponsored retirement plan that lets you defer taxes until youre retired. 1 Traditional 401 k deductible account fully funded contributions to Roth 401 k non. Protect Yourself From Inflation.

The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

G4wid7fis4mwmm

Compound Interest Make It Work For You David Waldrop Cfp

Compound Interest Calculator Daily Monthly Quarterly Annual

What Is Compound Interest Fisher 401k

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Calculator For Excel

Compound Interest Calculator For Excel

/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

What Is The Link Between Mutual Funds And Compound Interest

The Difference In Retirement Savings If You Start At 25 Vs 35

Accounts That Earn Compounding Interest

Fidelity Compound Interest

Compound Interest Formula Explained Compound Interest Compound Interest Investments Math Methods

Compound Interest Calculator Daily Monthly Quarterly Annual

The Power Of Long Term Compound Interest Investments Ticker Tape

Fidelity Compound Interest

Loading Savings Advice Budgeting Money Management